- About Us

About Us

We are a North American-based liquids infrastructure company that connects customers to markets, employees to rewarding careers, and investors to long-term value.

- Operations

- News & Stories

- Sustainability

Sustainability & ESG

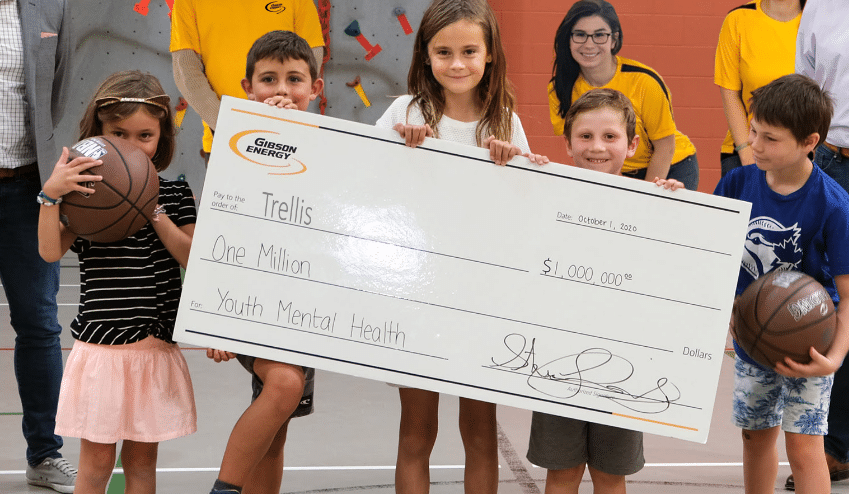

Safety, environmental protection and community play important roles in our growth as a company.

- Careers

Careers

It takes great people to make a great company.

We are powered by the diverse, skilled and innovative talent of our employees to ensure safe and responsible operations.

- Investor Centre

Investor Centre

We are a North American-based liquids infrastructure company that connects customers to markets, employees to rewarding careers, and investors to long-term value.

- Suppliers & Contractors

- About Us

About Us

We are a North American-based liquids infrastructure company that connects customers to markets, employees to rewarding careers, and investors to long-term value.

- Operations

- News & Stories

- Sustainability

Sustainability & ESG

Safety, environmental protection and community play important roles in our growth as a company.

- Careers

Careers

It takes great people to make a great company.

We are powered by the diverse, skilled and innovative talent of our employees to ensure safe and responsible operations.

- Investor Centre

Investor Centre

We are a North American-based liquids infrastructure company that connects customers to markets, employees to rewarding careers, and investors to long-term value.

- Suppliers & Contractors